Tax Calculator Pakistan 2025 – 2026

Pakistan Salary Tax Calculator

MONTHLY

Monthly Income:

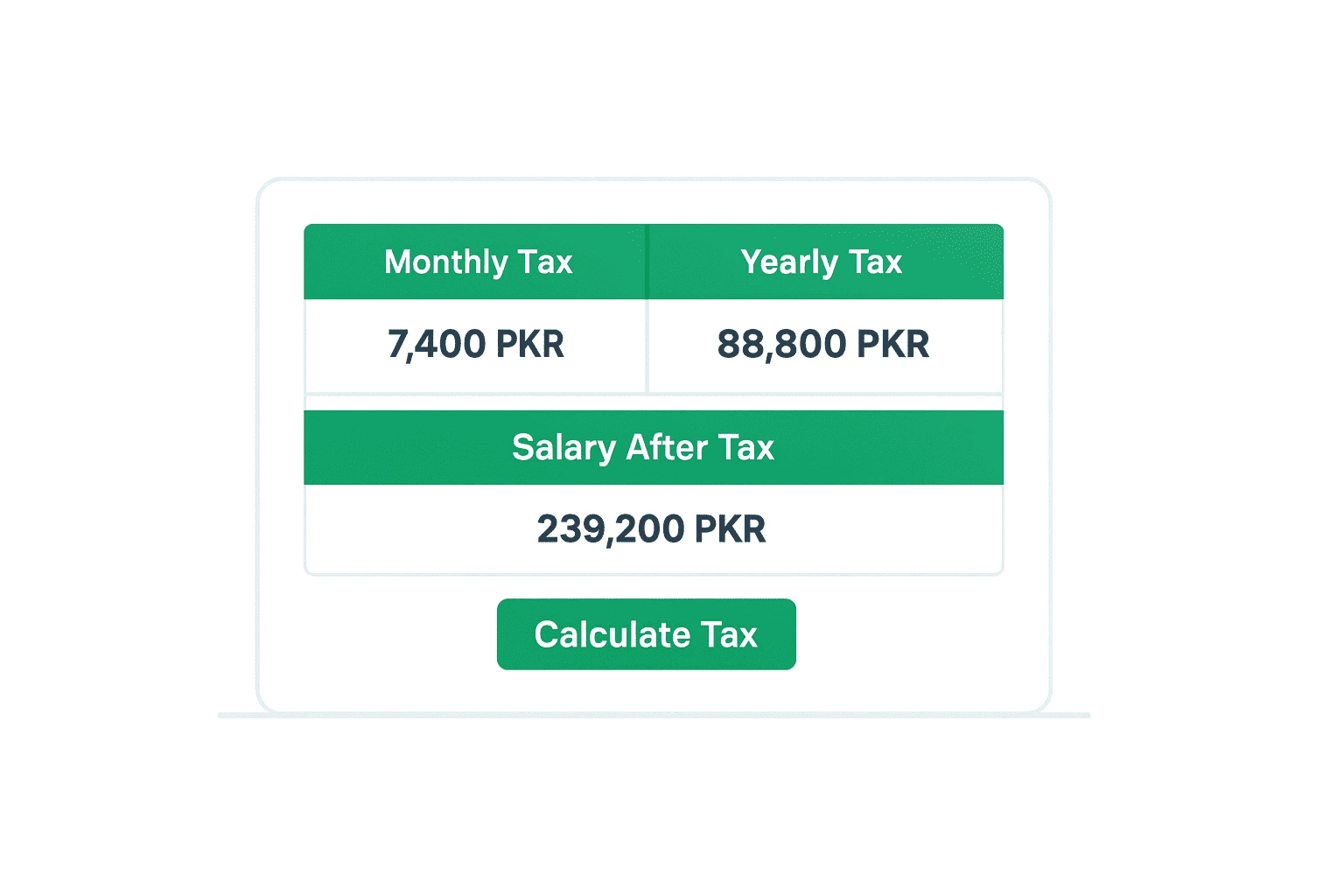

Monthly Tax:

Salary After Tax:

YEARLY

Yearly Income:

Yearly Tax:

Salary After Tax:

How This Pakistan Salary Tax Calculator Works

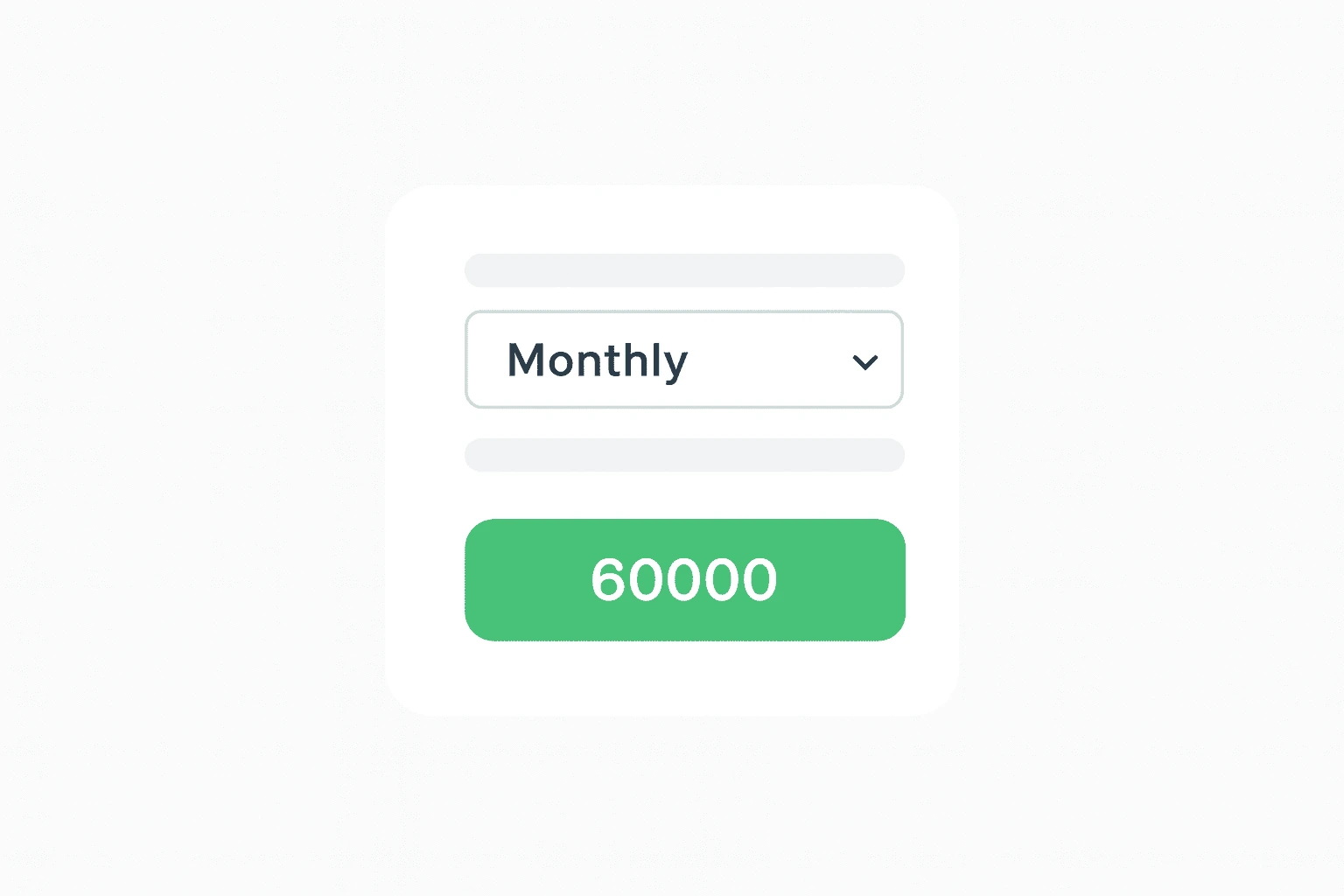

1. Select Salary Type and Enter Income

Start by choosing whether you want to calculate tax on your monthly or annual salary. Then enter your income amount in the field above. The calculator will automatically convert monthly salary to yearly salary when needed.

2. Choose the Relevant Tax Year

From the Tax Year dropdown, select the year you want to calculate tax for (for example, 2025–2026). The calculator instantly applies the latest FBR salary tax slabs for that year in the background.

3. View Your Tax and Take-Home Salary

Click on the Calculate Tax button. You’ll see your monthly tax, yearly tax, and salary after tax in a simple breakdown. This helps you quickly understand how much income tax you pay in Pakistan for the selected year.